Losing a loved one is an emotional and difficult time, even without handling the legalities and formalities of the deceased’s affairs. When you find yourself responsible for handling the deceased’s business at the end of death, where do you start? This post aims to explain the basics of probate, how it works, and what you should do in North Carolina under typical circumstances.

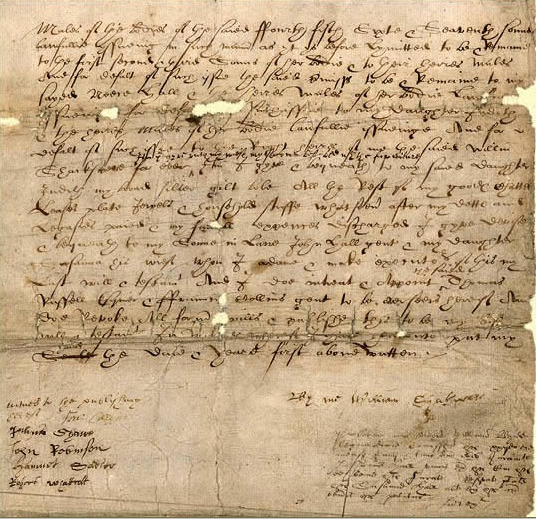

What is Probate?

Probate is the official legal process by which a will is honored. When a will is probated, an executor (sometimes called a personal representative) is appointed to administer the estate and carry out the wishes of the decedent, including distribution of the assets to the beneficiaries. Usually the executor is named in the will or, if there is no will, an administrator is appointed by the Clerk of Court. For more information on executors, click [here/hyperlink to 9/21 blog article].

Probate ensures the will’s validity, notifies the beneficiaries, identifies the deceased’s property, and ensures taxes and creditors are paid. In most cases, probate proceedings are simple and inexpensive. However, if the decedent has significant assets, or if there are disputes regarding the decedent’s estate, probate can be increasingly complicated and the assistance of an experienced attorney is necessary.

How Can An Estate Avoid Probate?

Avoiding probate essentially means the whole estate, or part of the estate, does not undergo the mandated court procedures. There are three ways to avoid probate: First, if the estate is small enough, court supervision is not required. Second, some assets (such as real property, retirement benefits, life insurance, and the like) do not pass through the estate, but transfer automatically to the named beneficiaries and/or heirs. Finally, if property is transferred into a trust prior to the decedent’s death, it is not probated.

Small Estates

If an estate is small and simple, formal probate proceedings are not necessary, whether the deceased left a will or not.[1] To determine whether an estate requires probate, it is only necessary to look at certain assets. If the person died after January 1, 2012 and the value of their personal property (minus creditor liens, debts, and spousal allowance) is less than $20,000, then the estate does not require probate after a thirty-day waiting period. Any executor, heir, creditor, or public administrator may file an affidavit with the Clerk of Superior Court requesting authorization to proceed with collection and administration of the estate. Requirements for the affidavit can be found here.

Alternatively, if the deceased left all of his or her assets to his or her spouse, the decedent’s spouse only needs to petition the Clerk of Superior Court for an order of summary administration.[2] Once the order is issued, the spouse assumes all liabilities of the deceased.

Asset Classes that Pass Outside Probate

If property is jointly owned, the property is not probated. When the death of one of the owners occurs, the property simply passes to the other owner. Likewise, retirement accounts and insurance policies that name a beneficiary are not probated since the assets are designated to go to that beneficiary. Finally, a Payable on Death (POD) account will likely also have designated beneficiaries, so those people would receive the money upon the death of the account holder.

Living Trusts

The third way to avoid probate is through creation of a living trust and, in many cases, is created for that reason. The assets pass according to the terms of the trust and with the assistance of the trustee or trustees. Living trusts can be used for many different kinds of assets, including, but not limited to, real estate, bank accounts, and vehicles. However, all assets must have been transferred into the trust prior to death for the terms of the trust to control.

What Are the Probate Steps in North Carolina?

If a will exists, it must be filed with the Clerk of Superior Court.[3] The Clerk will then issue “letters” to the person(s) who qualify as the executors. These “Letters Testamentary” authorize the executor to carry out his or her responsibilities. Unless the will specifies otherwise, the executor must post bond to insure against any wrongdoing. After the court issues the letters testamentary, the executor must identify the decedent’s assets, inventory them, and protect them within three months of the decedent’s death.

Next, the executor is required to alert all known creditors of the decedent’s death and inform them that the estate is in probate. For obvious creditors, like mortgage companies, the executor should notify them via certified or registered mail. For creditors that may not be so obvious, the executor needs to put a notice in the newspaper of the county where the will is being probated.

The executor should then secure a year’s allowance for the deceased’s spouse and minor children, if applicable. This can be done by filing a request with the Clerk of Court. Once it is approved, the money is given to the spouse and children before any creditors. It is important to note, however, that one can only get these funds from the estate’s cash assets or personal property. It is not permitted to liquidate any other assets for this purpose. The next step is to pay all debts and bills, such as medical bills, and sell assets if necessary to pay those bills. Regarding mortgaged real estate, the beneficiary should assume that loan. Other loans should be paid through the estate. If the executor disputes the validity of a creditor’s claim, they can reject the claim . However, a creditor can file suit to validate the claim.

Once the loans are paid, the executor should file taxes on behalf of both the individual and the estate if the estate earned any income during the probate period. The executor may also need to file an inheritance tax return with the state and pay any taxes that result. After all creditors and taxes are paid, the executor should distribute the remaining property pursuant to the terms of the will. The executor then provides a final accounting of with the Clerk of Court that shows all of the transactions the executor entered on behalf of the estate as well as evidence of those transactions.

Simple estates with few assets may not need to be probated. However, it is wise to consult an experienced attorney when dealing with complex estates and/or numerous assets. If an interested party challenges probate, it may be necessary to get the advice of an attorney experienced in trust and estate litigation. For more information, please visit us as www.lindleylawoffice.com.

[1] N.C. Gen. Stat. § 28A-25-1.

[2] N.C. Gen. Stat. § 28A-28-1.

[3] N.C. Gen. Stat. § 28A-15-13(d).